Ingénierie des réservoirs

Proven Reserves (1P)

Débloquer le réservoir : comprendre les 1P en ingénierie des réservoirs

Dans le monde du pétrole et du gaz, comprendre le potentiel d'un réservoir est crucial. Un terme clé utilisé en ingénierie des réservoirs est 1P, qui fait référence aux Réserves prouvées. Cet article explore la signification de 1P et son importance dans la détermination de la viabilité économique d'un réservoir.

Que sont les réserves prouvées (1P) ?

Les réserves prouvées, ou 1P, représentent la quantité estimée d'hydrocarbures qui sont considérées comme récupérables avec un degré de certitude élevé. Cela signifie que le volume de pétrole ou de gaz est considéré comme techniquement et économiquement faisable à extraire, en se basant sur les technologies et les conditions de marché actuelles.

Détermination des réserves prouvées :

Le calcul des 1P implique un processus rigoureux d'évaluations géologiques et d'ingénierie. Les facteurs clés incluent:

- Données géologiques : Cela inclut des informations sur la taille et la forme du réservoir, le type et la qualité du dépôt d'hydrocarbures, et la présence de barrières ou de pièges.

- Données de production : Les données de production historiques provenant des puits existants sont analysées pour évaluer les performances du réservoir et estimer la production future.

- Évaluations d'ingénierie : Les ingénieurs évaluent la faisabilité de l'extraction des hydrocarbures en utilisant les technologies actuelles, y compris les techniques de forage, de complétion et de production.

- Considérations économiques : Le coût estimé de production, de transport et de transformation sont pris en compte pour déterminer la viabilité économique de l'extraction des réserves.

Descriptions sommaires des réserves prouvées (1P) :

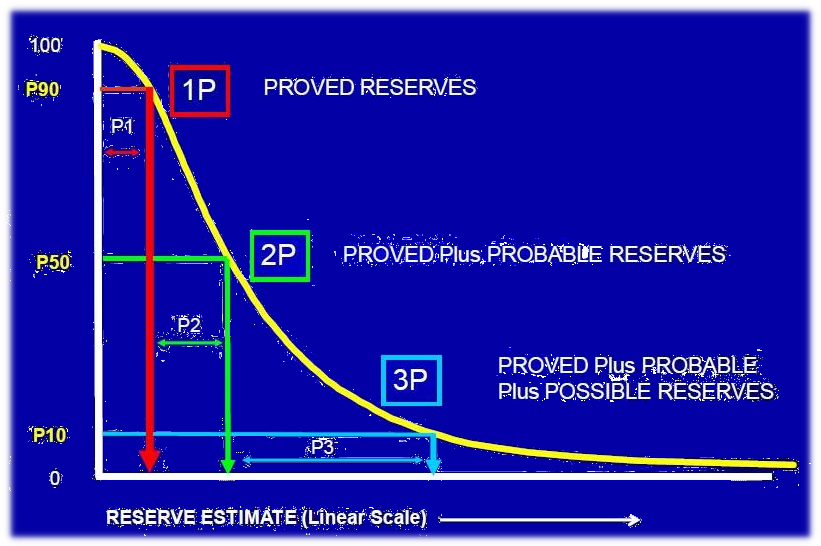

Les réserves prouvées sont généralement classées en trois niveaux:

- 1P (Prouvées) : La catégorie la plus certaine, représentant les hydrocarbures qui sont considérés comme "économiquement exploitables" dans les conditions actuelles.

- 2P (Probables) : Réserves qui sont moins certaines que 1P mais qui sont toujours susceptibles d'être récupérées. Elles peuvent nécessiter un développement supplémentaire ou nécessiter des prix du pétrole légèrement plus élevés pour être économiquement viables.

- 3P (Possibles) : La catégorie la moins certaine, représentant les réserves qui sont techniquement faisables à récupérer mais qui peuvent nécessiter des avancées technologiques significatives ou des prix du pétrole plus élevés pour devenir économiquement viables.

Importance des réserves prouvées :

1P joue un rôle crucial dans divers aspects de l'industrie du pétrole et du gaz:

- Décisions d'investissement : Les compagnies pétrolières et gazières s'appuient fortement sur les estimations 1P lorsqu'elles décident d'investir dans un réservoir particulier.

- Évaluation : Les réserves prouvées sont un facteur clé dans la détermination de la valeur d'une société pétrolière et gazière ou d'un actif spécifique.

- Gestion des ressources : La compréhension des réserves prouvées permet aux entreprises de planifier la production future et de gérer leurs ressources efficacement.

- Conformité réglementaire : De nombreux pays ont des réglementations concernant la déclaration des réserves prouvées, assurant la transparence et la responsabilité dans l'industrie.

Conclusion :

Les réserves prouvées (1P) sont un concept fondamental en ingénierie des réservoirs. Elles représentent la quantité estimée d'hydrocarbures qui sont considérées comme récupérables avec un degré de certitude élevé, ce qui en fait un facteur crucial dans les décisions d'investissement, l'évaluation et la gestion des ressources dans l'industrie pétrolière et gazière. En comprenant les 1P, les parties prenantes peuvent avoir une image plus claire de la viabilité économique et du potentiel d'un réservoir.

Test Your Knowledge

Quiz: Unlocking the Reservoir: Understanding 1P in Reservoir Engineering

Instructions: Choose the best answer for each question.

1. What does the term "1P" represent in reservoir engineering? (a) Possible Reserves (b) Probable Reserves (c) Proven Reserves (d) Potential Reserves

Answer

(c) Proven Reserves

2. What is the main factor that distinguishes 1P from 2P and 3P reserves? (a) The size of the reservoir (b) The quality of the hydrocarbon deposit (c) The certainty of recovery (d) The cost of extraction

Answer

(c) The certainty of recovery

3. Which of the following is NOT a key factor in determining 1P? (a) Geological data (b) Production data (c) Environmental impact assessment (d) Engineering evaluations

Answer

(c) Environmental impact assessment

4. What is the significance of 1P in the oil and gas industry? (a) It helps determine the environmental impact of oil and gas production (b) It is used to estimate the future price of oil and gas (c) It is crucial for investment decisions, valuation, and resource management (d) It helps predict the lifespan of a reservoir

Answer

(c) It is crucial for investment decisions, valuation, and resource management

5. Which statement BEST describes 1P reserves? (a) Reserves that are technically feasible to recover but may require advancements in technology (b) Reserves that are likely to be recovered but may require slightly higher oil prices (c) Reserves that are considered economically producible under current conditions (d) Reserves that are the most uncertain and may never be recovered

Answer

(c) Reserves that are considered economically producible under current conditions

Exercise:

Scenario: An oil company is evaluating a new reservoir for potential investment. They have gathered the following data:

- Geological Data: The reservoir is estimated to contain 500 million barrels of oil.

- Production Data: Existing wells in similar reservoirs produce an average of 10,000 barrels per day for 10 years.

- Engineering Evaluations: The company can access the reservoir using current technology with an estimated recovery rate of 70%.

- Economic Considerations: The cost of production, transportation, and processing is estimated at $40 per barrel. The current market price for oil is $60 per barrel.

Task: Based on the information provided, calculate the 1P reserves for the new reservoir.

Exercice Correction

**1. Calculate the total recoverable oil:** * Estimated oil in the reservoir: 500 million barrels * Recovery rate: 70% * Total recoverable oil: 500 million barrels * 0.70 = 350 million barrels **2. Determine if the reserves are economically viable:** * Cost of production per barrel: $40 * Market price per barrel: $60 * Profit per barrel: $60 - $40 = $20 Since the profit per barrel is positive, the reserves are considered economically viable. **Therefore, the 1P reserves for the new reservoir are estimated to be 350 million barrels.**

Books

- Petroleum Engineering Handbook: This comprehensive handbook, edited by William D. McCain, covers various aspects of reservoir engineering, including reserve estimation and classification.

- Reservoir Engineering Handbook: By Tarek Ahmed, this book provides detailed information on reservoir characterization, fluid flow, well performance, and reserve estimation.

- Fundamentals of Petroleum Engineering: By John C. Dake, this textbook offers a strong foundation in petroleum engineering concepts, including reserve estimation methods.

Articles

- "Understanding Proven, Probable and Possible Reserves" by the Society of Petroleum Engineers (SPE) - This article provides a clear explanation of the different reserve categories, including Proven Reserves (1P).

- "Reserve Estimation: The Role of Technology and Uncertainty" by SPE - This article explores the impact of technology and uncertainty on reserve estimation, highlighting the importance of rigorous analysis.

- "The Changing Landscape of Reserve Reporting" by Oil & Gas Journal - This article discusses the evolving trends in reserve reporting and the role of independent reserve auditors.

Online Resources

- Society of Petroleum Engineers (SPE): SPE's website offers a wealth of resources on reservoir engineering, including publications, technical papers, and industry standards related to reserve estimation.

- American Petroleum Institute (API): API provides guidelines and standards for reserve estimation and reporting, which are widely used in the industry.

- World Oil: This industry publication provides news, analysis, and technical articles related to oil and gas production, including reserve estimation.

Search Tips

- Use specific keywords: When searching for information, use specific keywords like "Proven Reserves", "1P Reserves", "Reserve Estimation", and "Reservoir Engineering".

- Combine keywords: Combine keywords to narrow your search, for example, "Proven Reserves + SPE" or "Reserve Estimation + API Guidelines".

- Use quotation marks: Enclose specific terms in quotation marks to search for exact phrases, such as "Proven Reserves (1P)".

- Explore different file types: Include specific file types in your search, such as "pdf" or "doc", to find relevant documents.

Techniques

Unlocking the Reservoir: Understanding 1P in Reservoir Engineering

This expanded version breaks down the topic of Proven Reserves (1P) into separate chapters.

Chapter 1: Techniques for Estimating Proven Reserves (1P)

Determining Proven Reserves (1P) requires a multidisciplinary approach combining geological, geophysical, and engineering data. Several key techniques are employed:

Material Balance Calculations: This classic technique uses pressure-volume-temperature (PVT) data and reservoir production history to estimate the original hydrocarbon in place and the remaining reserves. It's particularly useful in mature fields with extensive production history. Limitations include assumptions about reservoir homogeneity and fluid properties.

Decline Curve Analysis: This method analyzes the historical production decline rate to predict future production. Different decline curve models (exponential, hyperbolic, harmonic) are used depending on the reservoir characteristics. Accuracy depends on the quality and length of the production history and the applicability of the chosen model to the specific reservoir.

Reservoir Simulation: This sophisticated technique utilizes numerical models to simulate fluid flow and pressure behavior within the reservoir. It incorporates geological data, rock properties, and fluid properties to predict production under various scenarios. While powerful, reservoir simulation requires significant computational resources and expertise, and its accuracy depends on the quality of the input data.

Analogue Studies: This comparative approach uses data from similar reservoirs with known production history to estimate reserves in the reservoir being evaluated. Success depends on finding truly analogous reservoirs, which can be challenging.

Geological Modeling: Building 3D geological models of the reservoir is crucial. These models integrate seismic data, well logs, and core analysis to define reservoir geometry, porosity, permeability, and hydrocarbon saturation. This provides a framework for volumetric calculations and other reserve estimation techniques.

Volumetric Calculations: This is a fundamental technique that calculates reserves based on the reservoir's size, porosity, hydrocarbon saturation, and recovery factor. It requires accurate determination of reservoir geometry and rock and fluid properties. Accuracy is limited by the uncertainties inherent in these parameters.

Chapter 2: Models Used in 1P Estimation

Various models are used in conjunction with the techniques described above. These models range from simple empirical relationships to complex numerical simulations:

Arps Decline Curve Model: A widely used empirical model for predicting production decline. It assumes either exponential or hyperbolic decline.

Material Balance Equation: A fundamental equation describing the relationship between reservoir pressure, volume, and fluid properties.

Black Oil Reservoir Simulator: A type of numerical reservoir simulator that models the flow of oil, gas, and water in a reservoir.

Compositional Reservoir Simulator: A more advanced type of simulator that accounts for the changes in fluid composition due to pressure and temperature variations.

The choice of model depends on the complexity of the reservoir and the available data. Simpler models might suffice for mature fields with well-defined production history, while more complex models are needed for undeveloped or complex reservoirs.

Chapter 3: Software for 1P Estimation

Several software packages facilitate the estimation of proven reserves. These packages often integrate various techniques and models:

Petrel (Schlumberger): A comprehensive reservoir modeling and simulation software suite.

Eclipse (Schlumberger): A widely used reservoir simulator.

CMG (Computer Modelling Group): Another popular reservoir simulation software package.

RMS (Roxar): A suite of software for reservoir characterization and modeling.

Specialized Decline Curve Analysis Software: Several dedicated software packages exist for performing decline curve analysis.

The specific software used depends on the project requirements and the available resources. Many companies have internal workflows and custom tools built around commercial software.

Chapter 4: Best Practices in 1P Estimation

Accurate 1P estimation requires adherence to best practices:

Data Quality Control: Rigorous quality control of all input data is essential. Inaccurate or incomplete data can lead to significant errors in reserve estimates.

Uncertainty Analysis: Quantifying the uncertainty associated with reserve estimates is crucial. Monte Carlo simulation is a common technique used for this purpose.

Peer Review: Independent review of reserve estimates by qualified professionals helps ensure accuracy and objectivity.

Transparency and Documentation: Detailed documentation of the methodology and assumptions used in reserve estimation is vital for transparency and accountability.

Compliance with Industry Standards: Reserve estimates should comply with relevant industry standards, such as those established by the Society of Petroleum Engineers (SPE) or the Canadian Oil and Gas Association (COGA).

Chapter 5: Case Studies of Proven Reserve (1P) Estimation

(This section would require specific examples. Instead of providing hypothetical examples, mentioning types of case studies would be more useful)

Case studies would illustrate the application of the techniques and models discussed. Examples could include:

Case Study 1: A case study focusing on a mature field with extensive production history, demonstrating the use of material balance calculations and decline curve analysis.

Case Study 2: A case study illustrating the application of reservoir simulation to an undeveloped field, highlighting the challenges and uncertainties involved in estimating reserves in such fields.

Case Study 3: A case study comparing different reserve estimation methods for a specific reservoir, discussing the strengths and limitations of each approach.

Case Study 4: A case study analyzing the impact of uncertainty on reserve estimates, demonstrating the importance of quantifying uncertainty in decision-making. The case study could demonstrate different levels of uncertainty in various parameters (e.g., porosity, permeability, recovery factor).

These case studies would provide valuable insights into the practical application of 1P estimation techniques and the challenges involved. Specific details would need to be added based on available data and examples from published literature.

- Behind Pipe Reserves Réserves derrière le tubage :…

- Demonstrated Reserves Décrypter les réserves démont…

- Developed Reserves (reservoir) Réserves développées : La sou…

- Discovered (reserves) "Réserves Découvertes" dans l…

- Non-Producing Reserves Libérer le potentiel : Compre…

- PDNP (reserves) Réserves PDNP : Les géants si…

- PD (reserves) Comprendre les réserves PD (D…

- Possible Reserves (3P) Les 3P de l'ingénierie des ré…

- Probable Reserves Plonger dans le domaine des r…

- Probable Reserves (2P) Débloquer le Potentiel : Les …

- Proved Developed Reserves Libérer le potentiel : Les ré…

- Proved Reserves Comprendre les Réserves Prouv…

- Proved Undeveloped Reserves Réserves prouvées non dévelop…

- PUD (reserves) PUD (Réserves) : Comprendre l…

- Recoverable Reserves Débloquer l'avenir : Plongez …

- Contracted Reserves Réserves contractuelles : Un …

- Dry Gas (reserves) Gaz sec : La machine à gaz ma…

- Entitlement (reserves/production) Droits d'exploitation (Réserv…

- Managerial Reserves Réserves de gestion : le file…

- Possible Reserves Débloquer le potentiel : Comp…

- Demande de justification des dépenses Naviguer dans la de… Planification et ordonnancement du projet

- Coût budgété du travail planifié Comprendre le Coût … Estimation et contrôle des coûts

- Les limites de batterie Comprendre les limi… Termes techniques généraux

- Outil DV Outil DV : Un éléme… Forage et complétion de puits

- SOMMAIRE TOC : Comprendre le… Termes techniques généraux

Comments